bear trap stock chart

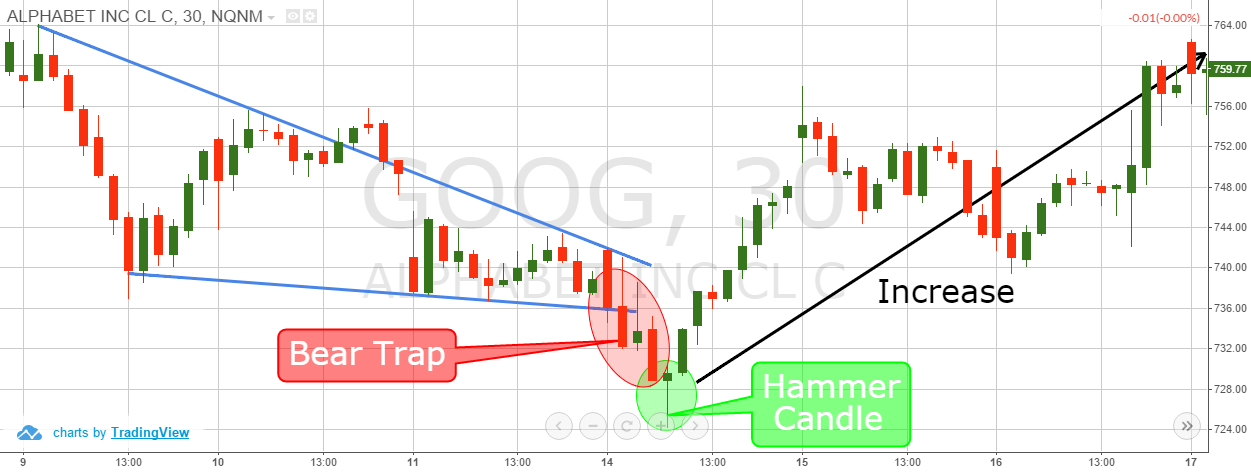

Web It occurs when traders take on a short position when the stock is breaking down hoping to buy back at a lower price but the trend reverses and shoots up. Web of a bear trap and how to avoid falling into one.

Impollinare Irregolare Protezione What Is A Bear Trap Settembre Ripido Lusingare

Web Support Level Bear Trap A good example of a bear trap can be found on the chart below.

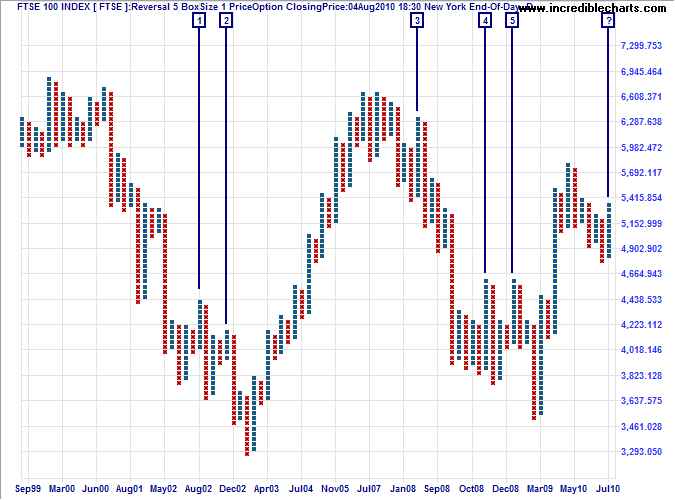

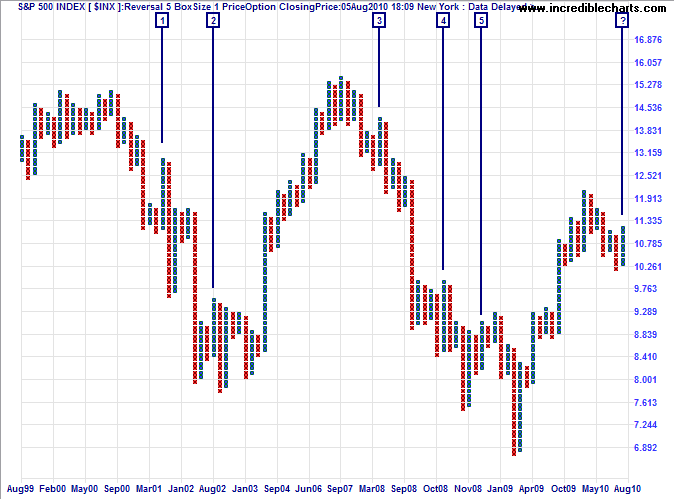

. A bear trap is a technical pattern that occurs when the price action of a stock index or another financial instrument incorrectly signals a reversalfrom a downward trend to an upward trend. Web To create the bear trap there is a level or area in the market that the trap will be created around. Web The above chart demonstrates that to achieve a 50 confidence level you would need to apply a filter of 5 boxes ie.

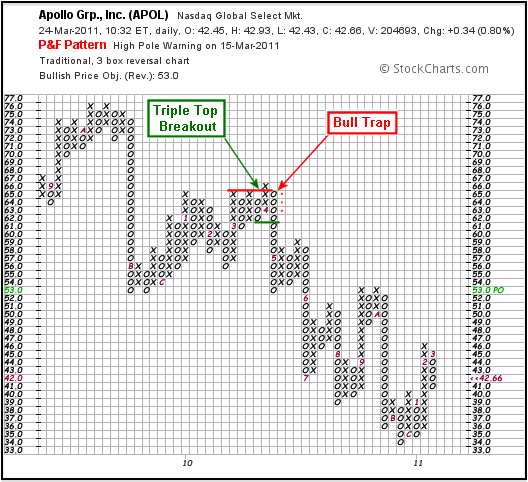

Web A bear trap occurs when institutional traders trap less experienced retail investors in order to provide liquidity to the market. A technical analyst might say that institutional traders try to create bear traps as a way of tempting retail investors to take long posit See more. Below is an example of a bear trap on 76 for the stock Agrium Inc.

Bear Trap Definition A bear trap occurs when shorts take on a position when a stock is breaking down only to have the stock. Web When a spike in volume occurs in conjunction with a price breakthrough a bear trap is generally not long behind. Below is an example of a bear trap on 76 for the stock Agrium Inc.

It produces a trap. Web Bear traps have a higher probability to happen when a large amount of a stocks float is short a market has an extremely bearish sentiment or sellers simply are. 50 to bull signals but only 3 boxes 30 for bear.

A trader who fell into the bear trap finds themselves in. Web Bear raid - In the context of general equities attempt by investors to move the price of a Stock opportunistically by selling large numbers of Shares short. Web Bear Trap Chart 3.

Web The above chart demonstrates that to achieve a 50 confidence level you would need to apply a filter of 5 boxes ie. As we can see GBPUSD is trading on a bullish trend on the daily chart. Resistance is normally associated with twomore equal highs or an earlier major.

Bull traps occur when an upward breakout retreats back below a resistance level. 50 to bull signals but only 3 boxes 30 for bear. This can be an area such as a major moving average but it is often a major.

Intraday charts can potentially reveal bear traps.

Bull Trap Vs Bear Trap For Sp Spx By Gpap90 Tradingview

P F Bull Bear Traps Chartschool

Bull Trap Or One Of The Most Useful Trading Patterns I Have Used

Here S How To Avoid Getting Caught In A Bear Trap While Trading Business Standard News

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Incredible Charts Bull Bear Traps In Primary Trends

Classic Bear Trap Swing Forex Trading Strategy Forexmt4indicators Com

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

Bear Trap Explained For Beginners Warrior Trading

Eur Usd Watch Out For Possible Bear Trap Short For Fx Eurusd By Forexn1 Public News Time

Bear Trap Trading How The Big Players Manipulate The Market And How To Trade With Them

Bear Trap Explained For Beginners Warrior Trading

Reminder From Literally Entire History Of The Stock Market Bear Trap Even Though I Am Bearish On The Next 20 Minutes R Stockmarket

How To Avoid A Bear Trap When Trading Crypto Bybit Learn

What Is A Bear Trap Seeking Alpha

Mengenal Bull Trap Dan Bear Trap Dalam Trading

The Stock Market May Have Just Escaped From A Bear Trap